PAN Card: Apply Online,Update PAN Card,Track PAN Card Status

By Result.News Editorial Team

Last Updated : 27 December 2025 | 04:37 PM

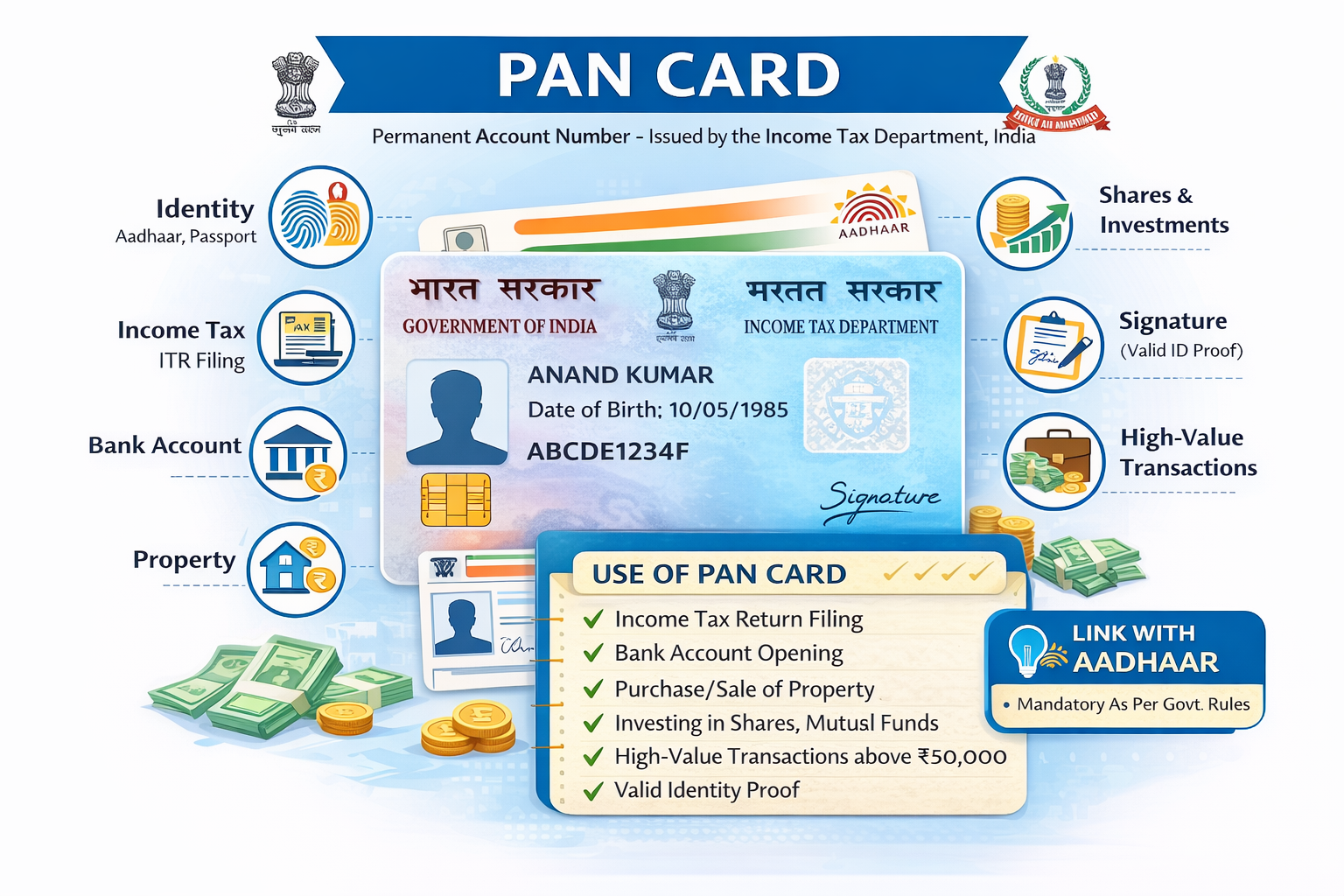

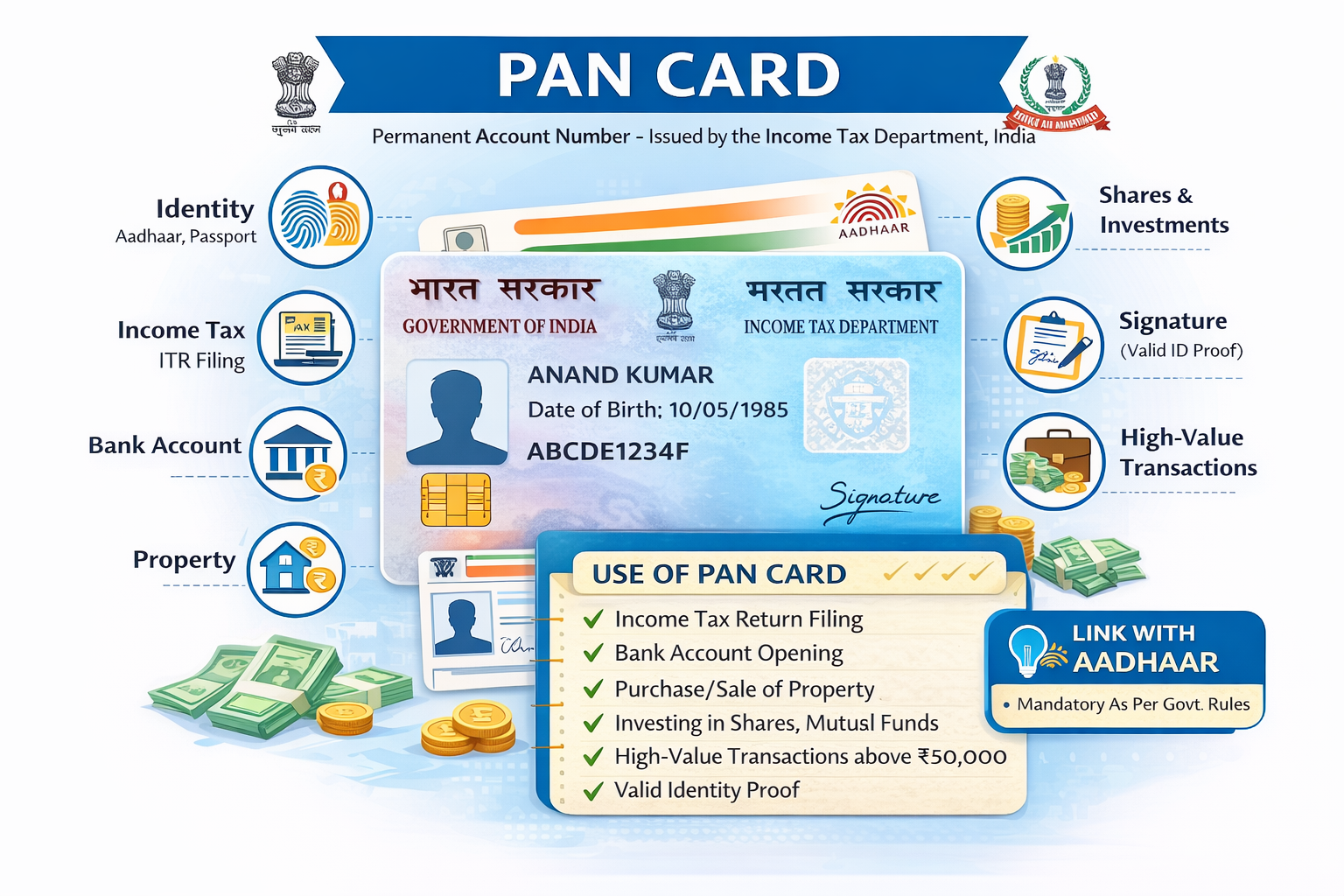

PAN(Permanent Account number) Issued By the Income Tax Department Of India.PAN Is a Alfanumaric 10 Digit Number,It Is Under The Supervision Of CBDT(Central Board of District Taxes),It Prevent Tax Evasion,snd used to track Financial Transactions,Its a valid Document for Lifetime use. This guide explains eligibility, age limit, documents, fees, step-by-step application process, and official links to apply for a PAN Card safely and correctly.

Permanent Account Number (PAN)Apply For PAN Card, Check PAN Card Status,Update PAN CardShort Details Of Notification |

||

Important Dates

|

||

Application Fee

Payment ModePay the fee Through the Debit Card,Credit Card,Internet Banking,UPI,IMPS,Mobile Wallet ,Online/Offline Mode. |

||

Pan Card Eligibility Details

|

||

Age Limit For Pan Card

|

||

Document Required To Enroll For PAN Card

|

||

Uses & Benifit of PAN Card

|

||

What Is e-PAN card-

|

||

|

Candidates who are intrested to check PAN Card Status,Update PAN Card, Apply for New PAN Card ,Read the intruction carefully |

||

Important Links |

||

| Check PAN Card Status | ||

| Re-Print PAN Card | ||

| Link Adhaar With PAN | ||

| Adhaar-PAN Linking Status | ||

| Official Website | ||

PAN Card For Forigen Citizens |

||

| Check PAN Card Status | ||

| Re-Print PAN Card | ||

| Link Adhaar With PAN | ||

| Link Adhaar With PAN Status | ||

| Adhaar-PAN Linking Status | ||

| Official Website | ||

|

For Any Queries And Feedback, Contact Us - [email protected] |

Frequently Asked Questions (FAQs) – PAN Card

How can I apply for a PAN Card and check PAN Card status?

Candidates can apply for a PAN Card online throughout the year as there is no fixed application start or last date. Applicants can also check PAN Card status and update PAN Card details online using the official PAN services.

What are the important dates for PAN Card application?

The PAN Card online application process is open throughout the year. There is no specific start date or last date for registration, and candidates can apply anytime.

What is the application fee for PAN Card?

The PAN Card application fee for all categories of Indian citizens is Rs. 107/-. Indian citizens who are residents in a foreign country are charged Rs. 989/- as PAN Card application fee.

What are the payment modes available for PAN Card application?

Applicants can pay the PAN Card application fee using Debit Card, Credit Card, Internet Banking, UPI, IMPS, Mobile Wallet, and Online or Offline payment modes.

Who is eligible to apply for a PAN Card?

Any Indian citizen of any age can apply for a PAN Card, as there is no age limit. Applicants below 18 years can apply through their parents or guardians. NRIs can also apply with extra fee charges. Firms and companies registered in India, as well as foreign citizens earning taxable income in India, are also eligible.

Is there any age limit for PAN Card application?

There is no minimum or maximum age limit for PAN Card application. Applicants of any age can apply. Candidates are advised to read government rules and regulations for more details.

What documents are required to enroll for a PAN Card?

Applicants must submit valid documents including ID Proof such as Aadhaar Card, Ration Card, Passport, Voter Card, or Driving License. Date of Birth proof includes Birth Certificate, Passport, Aadhaar Card, or High School Marksheet. Address proof includes Aadhaar Card, Bank Statement, Water Bill, Electricity Bill, Passport, or Rent Agreement.

What are the uses and benefits of a PAN Card?

PAN Card is required for financial and legal activities such as opening a bank account, filing Income Tax Return (ITR), buying or selling property, and large transactions above Rs. 50,000. It is also mandatory for loans, credit cards, investments in shares and mutual funds, and receiving salary or professional income.

How does PAN Card help in tax compliance?

PAN Card helps prevent tax evasion and is mandatory for filing income tax returns. It helps the government track financial transactions and also serves as a valid identity proof.

What is an e-PAN Card?

e-PAN is the electronic version of the PAN Card that is digitally signed. It is issued in PDF format, instantly downloadable, can be easily linked with Aadhaar, and is valid for all official purposes.

Is Aadhaar linking mandatory for PAN Card?

Yes, as per government rules, PAN Card must be linked with Aadhaar. If PAN is not linked with Aadhaar, it may become inactive. Linking PAN with Aadhaar is mandatory while filing Income Tax Return (ITR).